Renewable Energy Development in China: The Success of Centralized Policies by Cai May Tan '18

16 May 2018

Environmental Policy EMP 350

Professor George Busenberg

Introduction

The Chinese Communist Party (CCP) of the People’s Republic of China has held political and social power in the Chinese society for the past 60 years and counting (Lampton 2014). The communist rule during the cultural revolution period (1949 – 1977) has left socioeconomic legacies that have held back Chinese development, indicated by its trends in gross domestic product (GDP), mortality rates, education rates and more (World Bank Data 2018). Since the open economic reform of the 1970s led by Premier Deng Xiaoping, China has been advancing steadily to become the modern powerhouse of today. After Deng’s rule, China has become more fractured and decentralized over the years as Chinese civil society matures (Lampton 2014). Chinese society can no longer fall under the rule of the iron fist, having grown to be reliant on institutional structures with delegated powers and local governments that respond to the public’s opinion (Lampton 2014). However, China is far from adopting a democratic model of governance, and still relies on the central government planning for direction through policies, laws, funding and more. The decentralized rule and free market reform has led to rising inequality in China, like the rural-urban divide, which has allowed some places to develop more than others through favorable policies and free market allocation (Lampton 2014, Kahn and Zheng 2016).

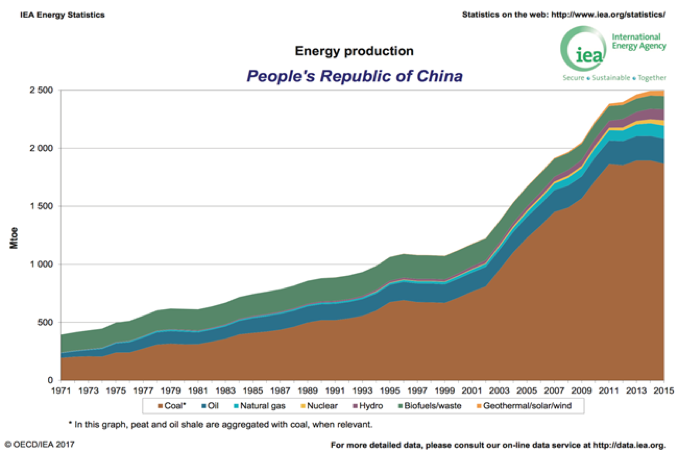

Home to a population of 1.4 billion people that is growing at an average of 10% per annum, China is the world’s most populous state and represents the second largest economy in the world after USA and before Japan (Kahn and Zheng 2016). Although China’s rate of economic growth has slowed down to the “new normal” as put by premier Xi Jinping, the state continues to undergo series of infrastructural, industrial and social development under its new era of reform (Sternfeld 2017). The population explosion in China that occurred concurrently with the boom of manufacturing and the resulting rise of consumer culture created huge concerns over energy generation (Shapiro 2016). Currently, 70 % of China’s energy is generated by coal (see Fig. 1). Renewables only account for 23 % of energy generation, 84 % of which is accounted for by hydropower generation (IEA 2017).

This paper will look at the successes of renewable energy development of China throughout the years, and explore the factors that led to the rise of China’s global dominance in the renewable energy sector. I argue that well-coordinated energy policies are the core of the rapid expansion but is catalyzed by China’s efforts in decentralization. The paper will also investigate how energy policy is implemented on a national and local level, and the dynamics between different stakeholders involved in energy generation and distribution. Finally, I would like to discuss the challenges each renewable energy resource is facing and their future outlooks.

China’s Environmental problems

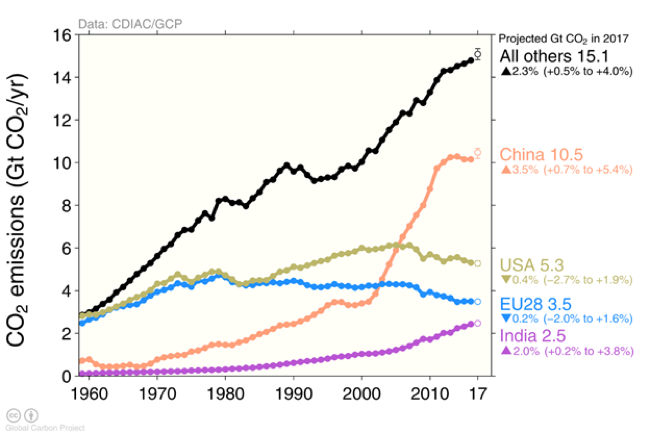

Much of China’s rise to economic dominance has relied on fervent industrialization driven by coal-powered energy. The emissions from coal combustion have contributed to high levels of sulfur dioxide (SO2), dust, nitrogen oxides (NOx) and carbon dioxide emissions (CO2) in China. China became the world’s largest carbon emitter in 2007 and has continued to be in this status today, emitting 10.5 Gt of CO2 in 2017 (see Fig 2). In 2015, China contributed to 30% of global CO2 emissions, and its per capita emissions exceeded the per capita emissions of 28 nations in the European Union or EU-28 (6.7 tonnes) (Sternfeld 2017). Reports from 2015 showed that energy consumption in China has continued to grow, and that China consumed up to 17% more coal in 2015 when compared to 2013 (Albert and Xu 2016). Thus, the international community has called upon China to take leadership in reducing carbon emissions through mitigation because of the nation’s contribution to climate change. China is one of the signatories to the Paris Agreement, and is mandated to further develop their mitigation plan via their National Determined Contributions (NDC) in the coming Conference of Parties (COP) (Gowen and Denyer 2017).

Over the years, concerns of air and water pollution arose that were linked China’s use of dirty coal to power its development (Ahlers & Hansen 2017). Air pollution was so bad in China, especially in cities, that the Chinese government masked the severity by omitting the measure of particulate matter smaller than 2.5 micrometers (pm 2.5) (Shapiro 2016). Increased use of motor vehicles has also contributed to degrading air quality in many Chinese cities. 40% of China’s population live in areas where air has been classified as unhealthy (Ahlers and Hansen 2017). Annually, observed air pollution can be attributed to 1.6 million deaths per year in China, which represents 17% of deaths in the country (Rohde & Muhler 2015). About 80% of the 367 cities in China have pollution that exceed the national standards in the 2015, prompting Beijing to establish China’s first emergency alert system for air pollution (Albert and Hansen 2017). After adoption of the Ambient Air Quality Standard, China’s government developed an air quality monitoring system, which contributed to further regulation on the local level (Rohde & Muhler 2015).

Another aspect of China’s environmental challenge is linked to the sustainability of the Chinese economy. The Ministry of Environmental Protection (MEP) of China has communicated its aims of promoting environmental preservation as well as increasing economic energy efficiency (Khan & Zheng 2016; Zhang 2011). As China’s population continues to rise, China will need sufficient natural resources to sustain stable economic growth in the long-term. Additionally, environmental degradation has become a substantial cost to China’s economy. In 2004, economic degradation in China was estimated to cost the equivalent of US $64 billion, representing 3.05% of China’s GDP (Zhang 2011). The danger of not responding to climate change effects and environmental health will be costly to long-term economic growth in China.

The environmental problems of China have also led to social insecurity and instability. Climate change has been leaving indicators in China, from increased severe weather to water shortages. Severe drought and harsh winters in Northern China has been driving people to abandon nomadic lifestyles and resettling in cities. Flooding events in the South of China have also contributed to displacement of towns (Khan and Zheng 2016). In the years to come, there will be increased flow of people into urban areas in China due to environmental stress. In 2010, there was one pollution-related incident reported every other day in China (Zhang 2011). These pollution-related problems are part of China’s growing number of environmental incidents, leading to greater social distrust and negative opinions on the Chinese government’s ability to manage environmental resources and incidents. As China is one of the largest contributors to anthropogenic factors of climate change, China has a responsibility in regulating its greenhouse gas (GHG) emissions. Therefore, energy policy is put in the spotlight to be one of the measures to tackle the bulk of China’s environmental problems.

As China continues to grow, albeit at a decreasing rate, the Chinese government have an interest in energy matters. Part of the interest stems from the civil society and international community’s pressure to deal with the environmental problems associated with coal burning, but the Chinese government is very concerned with energy security (Sternfeld 2017). Chinese leaders are aware of the economic costs of environmental degradation, and that long-term economic growth will be costly if climate change and environmental health are overlooked (Zhang 2011). From a political and economic standpoint, having reliable energy sources is a form of power. Since China has enough renewable energy resources that are able to generate sufficient energy to power China, the Chinese government have already been taking action to take advantage of the renewable resources in China, which include wind, solar and hydropower energy (Sternfeld 2017).

Environmental Regulation in China

Most of China’s climate change plans has come from the National Development and Reform Commission (NDRC) since the late 1990s. As for environmental policies that fall outside of the climate change agenda, the National People’s Congress are in charge of issuing national goals and regulations. The Ministry of Environmental Protection (MEP) of the People’s Republic of China is responsible of managing the environmental policies set by the centralized powers. However, China’s decentralization move has allocated administrative power to provincial governments. The national environmental policies are implemented at a local level at their discretion. Local actors are allowed to come up with more detailed plans and actions to reach their goals, reflecting the decentralized approach to environmental regulation in China.

]The problem with a decentralized environmental regulation system is that not all environmental policies will be equally accounted for. To begin with, the state government has had many shortfalls with environmental regulation due to shortages of human resources, budget cuts, monitoring capacity and more (Li, Miao and Lang 2011). Many high-ranking officers and their agencies prioritize economic development over environmental regulation, because the outcomes of the free market provide higher incentive than accounting for externalities at an economic cost (Li, Miao and Lang 2011). Prior to the green agenda, China’s national government has set its agenda on economic growth and has provided a system of incentives to push for development at local levels, like promoting officials for building new infrastructure (Kahn and Zheng 2016). Many local governments have since established the same mechanisms and priorities to promote economic growth in their region that varies according to the resources and economic opportunities available in their respective regions (Sternfeld 2017). As a result, it has become increasingly challenging for the state government to intervene with the varied set of political and economic systems in different regions. The polarization between central and local government agendas have been studied, but research has shown that the central government is trying to keep the balance between economic advancement and environmental protection through channels of power that it still controls (Li, Miao and Lang 2011).

Most of the action taken by local governments to transition into a new agenda of renewable energy deployment is influenced by central policy decisions. Generally, the Chinese government would release a set of policies as part of a government plan, like China’s Five Year Plan (FYP) that focuses on economic development. Following that, states would adopt environmental policies or mandates that meet the goals and targets of the plans (Sternfeld 2017). However, the variation of commitment from local governments result in varying levels of policy implementation and monitoring in regions across China (Sternfeld 2017). Variation of commitment can be explained by the incentives that local government leaders receive. The central government is able to organize politically-driven enforcement campaigns to make selected policies to be prioritized at a local level, which local leaders have to abide by or risk losing their positions of power.

However, some city mayors, especially younger mayors, are recognizing the economic impact of environmental and social externalities caused by environmental degradation on the city’s budget. More mayors are responding to implementing environmental regulations to support the so-called “blue skies agenda” (Kahn and Zheng 2016). For example, the coastal cities of Dalian, Zhuhai and Xiamen have formed environmentally-friendly plans under the State Environmental Protection Model Cities group, which lays out proactive initiatives at the local government level (Li, Miao and Lang 2011; Sternfeld 2017). The emergence of environmentally-driven states alludes to the growing push for ecological modernization after relative economic stabilization, driven by a more mature civil society and its leaders (Li, Miao and Lang 2011). However, the relationship of how local governments are able to influence regional and national agendas in China are not yet studied (Li, Miao and Lang 2011).

In the private industry, non-governmental work or agendas have been limited by government regulations. Environmental NGOs (ENGOs) are prevalent and people-led, but are limited in terms of their political influence as is typical within authoritarian systems of government (Shapiro 2016). However, Government-Organized NGOs (GONGOs) help organize political voices in support of an environmental agenda among the people and politicians both. The All-China Environmental Federation (ACEF) and the China Environmental Protection Foundation (CEPF) are government-funded examples of GONGOs that have raised funds for environmental protection, facilitated environmental partnerships and funded projects on a national level, in line with the MEP’s policies (Shapiro 2016). GONGOS allow the government of China to provide state-funded outlets for environmental interests and concerns, thereby reducing the risk of environmental interests directly challenging the government. Many international ENGOs face challenges entering and operating in China because of the state’s policies and limitations. However, as many as 10,000 international ENGOs are active in China today (Shapiro 2016). Some organizations like Greenpeace and Wordwide Wildlife Fund (WWF) have been able to form alliances with the MEP to facilitate negotiations. The reality that government bodies face is they need to rely on NGO support to maintain a harmonious and productive working environment on the basis of compromise. NGOs are also a formal way that government agencies can identify movements and how people are organizing politically.

Citizen movements have been able to create pressure on the government to take serious actions on environmental problems. In China’s highly censored and monitored civic society, the population have taken to the Internet to hold the government accountable. In response to the perceived threat of civic communications on the Internet, the government of China has implemented a sweeping Internet censorship program. Citizens’ online presence therefore does not translate into national political action, which limits civilian participation or say in these matters. Still, it remains that citizens are able to effect change on a more local level under the Internet wave of pushing for the new normal. The 2015 Tianjin blasts, a series of explosions caused by overheating of chemicals in the Tianjin port container storage, revealed that the Chinese government still has to push for stricter regulations and exercise policy implementations on a local level. Even though there was censorship throughout the investigation process, netizens (internet users that are active in microblogging and commenting, rampant in China) and media pressure scrutinized the process to reveal corruption at the local and private level, leading to jailing of 49, including 25 government officials, and the death sentencing of the warehouse company chairman (Kennedy 2016; Sternfeld 2017).

Renewable Energy Policy in China

The renewable energy policy agenda of China is set by a few parties, mainly the State Council-based NDRC, the State Electricity Regulatory Commission (SERC), and the energy generation industry. The NDRC is responsible for developing China’s policies, and the Ministry of Environmental Protection (MEP) manages the policies’ implementation and monitoring (Kahn and Zheng 2016). China’s renewable energy development, especially large-scale projects like power plants and grid connections, are attributed to a series of policies and plans launched by the NDRC.

China’s FYPs are broad economic plans that map out strategies for socioeconomic reform, development and setting targets that started in 1953 (Zhang 2011). The FYPs started setting development targets for renewable energy starting in 2006 with the 11th FYP (Zhang 2011). Prior to the 11th FYP, the Chinese government had ventured into research and development of renewable energy technology, but under more experimental and more research and development-based intentions (Zhang 2011). The 12th FYP laid out extensive targets for low-carbon development, which included renewable energy deployment, industrial expansion, and research and development (Sternfeld 2017). One of the significant targets was to increase non-fossil energy sources to 11.4 % of total energy use by 2015, which prompted more renewable energy deployment in China (Sternfeld 2017). Currently, the 13th FYP has set to increase non-fossil energy sources to 15% by 2020 (Sternfeld 2017).

Another NDRC initiative that has been successful is the National Action Plan of Climate Change launched in 2007 (Zhang 2011). The plan outlines the impacts China faces from climate change, as well as the mitigation actions China should and have adopted. It should be noted that most of the policies in the plan were from the 11th FYP (2006 – 2011) (IEA 2018). Among its objectives, the main goal was to achieve energy efficiency by reducing the energy consumption per unit GDP by 20% by 2010, and quadrupling GDP by 2020 but only doubling energy use (IEA 2018). In the wake of the plan’s push for energy efficiency, the NDRC also launched its 2007 Energy Conservation Law and the Top 1000 Energy Consuming Enterprises program, both requiring better energy consumption reporting and efficiency reform (Gallagher and Lewis 2016).

In terms of renewable energy deployment, the State Council launched the Renewable Energy Law in 2006, later revised in 2009, that is still in force (Gallagher and Lewis 2016). The law consisted of four mechanisms to enhance renewable energy deployment in China, which are to set a national renewable energy target, implement a feed-in-tariff (FIT) system, implement a cost-sharing mechanism, and establish a mandatory connection and purchase policy for power plants and local governments (Gallagher and Lewis 2016, IEA 2018). In the following year, the NDRC launched the now supersede Medium- and Long-term Plan for Renewable Energy Development in China that clarified China’s renewable targets (Lewis 2013). The plan established technology-specific targets for wind, solar and hydropower energy generation, and called for standards of 1 % non-hydro for total renewable energy generation by 2010, and more than 3 % by 2020 (Lewis 2013). The big five state-owned power companies (Guodian, Datang, Huaneng, Huadian, and Guohua) were obligated to take lead on renewable energy standards of 3 % capacity by 2010 and more than 8% by 2020 (Lewis 2013).

China’s carbon-trading mechanism was also in line with the government’s pledge to cut carbon emissions by 40-45% by 2020 relative to 2005 levels (Zhang 2011). A few experimental carbon trading and cap-and-trade programs for CO2 have taken place in China (Gallagher and Lewis 2013). The regional cap-and-trade programs were announced in 2011 to take place in Guangdong, Beijing, Tianjing, Shanghai, Chonqing, and Shenzhen, which have completed their pilot phases which proved to be successful (Hal and Min 2017). As the market has stabilized, China has launched a regional carbon-trading scheme that is set to take place in the aforementioned regions in 2018 (Hal and Min 2017). The emissions trading scheme will be significant because it will fulfill China’s long-term commitment to cutting down China’s carbon emissions, as well as their NDCs for the Paris Agreements (Hal and Min 2017).

As the world’s largest CO2 polluter, China has made progress in response to making China a greener place. In 2002, China officially ratified the Kyoto Protocol but its status as a non-Annex I country does not require China to cut down GHG emissions (UNFCCC 2016). More recently, the national government of China has undertaken major renewable energy initiatives and set China on a path to reduce GHG emissions. China ratified the 2015 Paris Agreements in 2016, but like the Kyoto Protocol, the Paris Agreements have less mitigation conditions for non-Annex I countries. On a national level, the Chinese government has tackled GHG emission in separate focal areas. Under the United Nations Framework Convention on Climate Change’s (UNFCCC) Clean Development Mechanism (CDM), China is building momentum to implement emission-trading schemes since mid-2005, which gave rise to the nation’s first Climate Change program in 2007 (Zhang 2011). China is already host to the largest number of CDM projects that includes many renewable energy projects, fulfilling its status as a leading nation in green development, and is currently focusing on implementing a national carbon trading scheme that just launched in December 2017 (Hal and Min 2017).

Government Support of Renewable Energy Expansion

As of 2015, up to 24% of China’s energy is generated by renewable means (EIA 2015). Hydropower is still leading in renewable energy, contributing to 79.3% of the renewable generation share. Wind comes in second by generating 13% of the renewable energy in China, followed by biofuels, solar and waste (EIA 2015). Today, China is the largest renewable energy producer in the world at 1.4 GWh, exceeding the world’s second largest producer, United States (0.6 GWh) (EIA 2015). Most of China’s renewable energy development occurred in the early 2000s, and was initiated and heavily supported by the Chinese government (Yang 2017). In the following section, I will give an overview of China’s renewable energy development over the years and discuss how centrally-planned policies and government intervention have helped in energy expansion. The case studies of each renewable energy will demonstrate how the national government are able to manipulate economic conditions and regulations to expand the nation’s renewable energy generation capacity.

Hydropower: The Power House

Hydropower is the second largest electricity source in China, making up 19.3 % of China’s electricity generation (EIA 2015). As with most hydropower plants, China’s history of building hydropower dams has been centrally planned. The development of power dams in China has had many successes, having constructed 960 hydropower plants that were centrally planned, which contributed to Kyoto Protocol’s CDM projects (Zhang 2011). However, there have been setbacks with hydropower development. For example, Mao Zedong’s Sanmenxia dam project, which at the time was a symbol of domestic technological advancement, did not fare well. Built in 1957, the development occurred massive ecological and social cost, including the relocation of the population inhabiting the Yellow River mainstream delta and increasing flooding risks caused by silt buildup from deposits (Yang 2017). Despite many protests from the population and advice from experts, Mao went ahead with the plan. As a result, silt accumulated in the dam months after its opening and is now known as one of the largest failures of water management in China (Yang 2017). The failures of the Sanmenxia project are still censored from public knowledge and China did not develop any major projects until the 1980s, pushed forward by then leader Deng Xiaoping (Yang 2017). This represents a classic case of poor planning and mismanagement of resources that China encounters in the early stages of technological development (Yang 2017).

Although China opened up to using better site research and technology to build its hydropower capacity, China exercised the same can-do attitude Chairman Mao had utilized to see their projects through. By the late 2000s, hydropower generation doubled in China, and by 2015 the hydropower generation capacity (potential output) and output were 1960- and 1567- times more than the 1980s (Yang 2017). With Chinese hydropower capacity at 320 GW and 1126 TWh generation, China has used hydropower to meet clean energy goals, as part of its green rebranding. In 2010, China was leading in Clean Development Mechanisms (CDM) worldwide, hydropower represented 42% of its projects. NDRC’s decision to transfer hydro-generated electricity to state grid corporations like SinoHydro and China Three Gorges Corporation (CTGC), energy storage capacity quadrupled from 2004 to 2015 (Yang 2017). Even though hydropower is considered a green energy source, it has caused large-scale damage and relocation in China as mentioned above. However, China is still pouring resources into hydropower, with goals to expand to 380 GW capacity by 2020, including 80 GW of small hydropower by 2020 under the 13th FYP (Yang 2017).

On the other hand, small hydropower, defined as plants generating <50 GW by the Chinese government, is on the rise in rural China. The Chinese government’s continuous support in financial investment have helped rural areas to switch from coal or firewood fuels to renewable energy sources. As of 2014, there are 47,000 rural hydropower stations, covering 1,700 counties and 30 provinces in China (MWR n.d.). The total installed capacity of rural small hydropower stations was 73 million kW, which was equivalent to substituting 73 million metric tons of coal and 183 million metric tons of CO2 emission (MWR n.d.). The central government started the campaign of using small hydropower as a means to improve rural household access to electricity. The Chinese government’s endeavor succeeded by raising accessibility from 40% to 98% today, meeting its goals for increased hydropower capacity in the 7th to 12th FYP (MWR n.d.). In 2016, it announced its plans to invest US $2.6 billion into small hydropower (FS-UNEP and BNEF 2017). Many households gained from having a reliable energy source that also generates revenue.

Hydropower will still dominate China’s move into a new era of green energy because of its competitive price in the long-run, its abundant water resources and its energy capacity storage. As China moves on to expanding solar and wind energy generation, hydropower will be a useful tool in storing power, ensuring China’s energy security in the foreseeable future.

The Sun Shines on the Future of Solar

Solar power capacity and generation in China rose almost overnight, from a mere 23.51 MW in 2001 to 78 GW in 2016, overtaking annual installation capacity of the world’s solar powerhouse Germany in 2015 (IEA 2016a, Sternfeld 2017). China’s centrally-planned policies supported technology development and deployment in the early stages of solar power in China. Compared to the establishment of hydropower, China’s approach involved private companies, economies of scale and the boom of the photovoltaic (PV) market. Relying on its power of market influence, the Chinese government intervened in the process by encouraging deploying domestically-produced PV modules, favorable tariffs, research funding, subsidies and more (Li 2015). In this so-called “third industrial revolution” rush to develop green technology, China is not only in line to transition into a renewable electricity source, but also has succeeded in building national energy security with its global dominance of PV manufacturing.

The National Energy Administration (NEA) of China proposed thirty- and fifty-year plans for installed solar, having a constant growth of 30 GW per year up until 2050 (Li 2015). In line with these goals, China’s FYPs have strongly backed the expansion of solar power capacity. The 13th FYP have the same 2020 targets as the NEA proposal of 100 MW, up from the 12th FYP achievements of 43 GW in 2015 (IEA 2016b). On a national scale, the NDRC pushed for deployment of solar generation in Western China, including Tibet, Inner Mongolia, Gansu, Ningxia, Qinghai and more (Li 2015). Project 390 was part of NDRC’s experiment of building PV power plants in the general Gobi area, subsidizing 1.15 RMB/kWh before establishing grid connection in 2011 (Li 2015). The installation focus shifted in recent FYPs to PV deployment in middle and eastern regions of China, including Shandong, Jiangxi, Hebei, Henan and Anhui (IEA 2016a).

The Chinese government played it well by building foundation to establish solar power generation in many areas. Private and state-owned companies were responsible for most of the expansion that happened in the mid-2010s. For example, after deploying PV power plants in Western China, NDRC invited Hanenergy, a now private renewable energy firm, to invest in Qinghai, generating more than 30 PV installation companies. The effort resulted in 1.003 GW of installed capacity in the province, representing 50% of total installed capacity in China (Li 2015). This eventually spread to other provinces in the region. Additionally, the Chinese government launched the Golden Sun demonstration program to open up a domestic market for domestic PV makers at the same time PV prices dropped worldwide (Yang 2017). The strategy included huge subsidies of approved projects that generate more than 500 MW capacity. However, only 157 out of 354 projects ended up connecting to the grid, not achieving the government’s vision (Yang 2017). EXPLAIN. Still, the State Council issued the “Several Opinions of the State Council on Promoting the Healthy Development of the Photovoltaic Industry” in 2013 to open up PV market in China, allowing state-owned companies to develop projects to independently supply PV power in hard-to-reach areas (Li 2015). The current premier of China, Li Keqiang, also proposed economic measures like favorable tariffs and funding to support commercialization of key materials and PV modules in 2013 (Li 2015).

City governments have seen the global rise of PV as an economic opportunity. Wuxi’s city government funneled US $6 million into China’s first 10 MW PV cell production line for Suntech Power in the early 2000s. Suntech’s success in building China’s PV manufacturing capacity encourage many other companies to join the PV production market (Yang 2017). In 2010 and 2011, Suntech became the largest PV manufacturer in the world, before crashing in 2013 because of market saturation (Yang 2017). Urban and rural programs were also initiated on county-levels to install rooftop PV cells, in places like Shanghai (Yang 2017).

Is Wind Energy the New Superpower?

Wind energy development in China is relatively new compared to the development of hydropower and solar energy. Concentrated efforts from the Chinese government to expand wind energy only came about in the 1980s, which relied heavily on foreign imports, grants and loans (Yang 2017). By the end of 2015, China had already installed 145 GW of wind power, which is more than all of the European Union (EU) combined (Sternfeld 2017). Most recent statistics shows that wind energy accounts for 3.3% of total energy generation in China, which has increased from 2.8% in 2014 (Lewis 2013).

Much like solar energy development in the recent decades, the Chinese government has invested heavily in wind turbine manufacturing industry and developing the domestic market for electricity generated from wind energy. In the 1980s, Chinese wind energy industry formed foreign-partnerships, specifically with the United State and Japan (Sternfeld 2017). The partnerships fostered technology transfers and exchanges, allowing China to develop its manufacturing capacity, leading to market entry in the 2000s (Sternfeld 2017).

The establishment of wind energy industry was supported by the Ministry of Electric Power (now defunct) through their Provisions for Grid-Connected Wind Farm Management program in 1994 (Lewis 2013). The program mandated the first wind facility-to-grid interconnections on a larger scale in China, as well as set a purchasing price for wind-generated electricity to the grid (Lewis 2013). Further programs on expanding facility-grid connections were mainly through the Medium- and Long-term Plans for Renewable Energy Development in China. The plan included targets like 5 GW of grid-connected wind power by 2010 and 30 GW by 2020, which has since increased to 200 GW by 2020 and 1,000 GW by 2050 (Lewis 2013, Yang 2017).

Additionally, the renewable energy development plan focused on developing large-scale wind power bases in regions that were selected by the government, which are mainly coastal and rural areas of China like Xinjiang, Eastern and Inner Mongolia, Hebei and Gansu (Lewis 2013, Yeung, Dai and Wu 2016). Most of the bases are being set up and are expected to be completed in the 2020s (Lewis 2013). The establishment of bases attracted wind turbine manufacturers, bringing in economic development into the regions mentioned above (Lewis 2013). Many provincial and local government have responded to manufacturers by providing economic incentives, competing for manufacturers. Local governments in these areas also had more freedom in setting up wind electricity pricing systems, offering bidding systems and feed-in-tariff (FIT) rates to encourage installation and wind energy development in their respective regions (Lewis 2013). For example, Guangdong was able to offer FIT rates of RMB 0.258 per kWh in 2004, which increased to RMB 0.689 per kWh in 2006 (Lewis 2013). The NDRC has since released a Notice on Improving Grid-Connected Wind Power Tariff Policy in 2009 that standardized wind energy pricing systems and fixed return on investments, which organized transactions and development process for wind farms in China (Lewis 2013).

The NDRC supported the expansion of wind installation capacity in China through a series of six wind power concession programs from 2003 to 2007 (Lewis 2013, Yang 2017). The concession programs focused on creating low electricity prices for wind energy and high domestic content in wind turbines to expand domestic manufacturing industry (Yang 2017). Domestic content standards mandates increase from 50 % in 2003 to 75 % in 2006 (Yang 2017). As a result, manufacturing capacity was increased from less than 0.6 MW to 3 MW by 2010 (Yang 2017). Additionally, the programs awarded tariffs for projects, with guaranteed grid connections, power purchase agreements and more (Lewis 2013). The latest concession program launched in 2010 was geared towards developing offshore wind power plants in the Jiangsu province (Lewis 2013). In this round of concessions, China encouraged more investment from private and domestically-owned firms by setting bidding requirements (Lewis 2013). The overarching Renewable Energy Law launched by the central government in 2006 also kick-started bundles of preferential policies for tax reduction, subsidies, resource surveys, certification and more for the wind energy industry (Yang 2017).

Even though the wind energy sector has developed at an increasing rate in the past 20 years, the renewable energy source still faces challenges in China to become a dominating source of electricity as hydropower has. Wind generation potential has been estimated to be 2,380 GW onshore and 200 GW offshore, which is smaller than the existing 1,126 TW generated by current hydroelectricity sources (Yang 2017). In Northern China that has the most abundant wind resources, combined heat and power (CHP) systems have proven to be less flexible in incorporating wind energy as a primary energy source (Lewis 2013). Instead, the energy source alternates between coal and wind energy, and coal plants have to be kept running (Lewis 2013). Additionally, the lack of transmission capacity has prevented wind energy to be successfully integrated into electricity markets that are separated geographically (Lewis 2013). At times the Northern regions and the Xinjiang province have generated an excess of wind energy supply, leading to levies against wind energy in Xinjiang (Lewis 2013).

Is Bioenergy Viable?

The bioenergy sector in China consists of biomass, biogas, bioethanol and garbage incineration for electricity generation, accounting for 0.67% of total primary energy consumption in 2010 and 0.81% in 2015 (Yang 2017). Although not considered to be entirely renewable, the bioenergy sector is worth discussing in China’s context because of the amount of industrial and agricultural by-products that may go into bioenergy production. Bioenergy is the least successful renewable energy in China, as most of their targets went unmet for the 11th and 12th FYP (Yang 2017). Biogas is the most successful bioenergy generation source, supported by central government as part of rural development projects (Yang 2017). As a result of these programs, rural households with biogas systems now stand at 40 million, whereas industrial biogas systems rose to 50,000 by 2015 (Yang 2017). The government still continues to support biogas development, as the FYP has switched focus to developing industrial biogas systems in bioenergy (Yang 2017).

China’s central government has continued to support the biofuel industry, which consists of bioethanol and biodiesel starting from the 10th FYP, even though biofuel has not rose to its potential yet (Yang 2017). The NDRC has set a goal for China to produce at least 12 million tons of biofuels by 2020, accounting for 15% of transportation fuel, with the intention of replacing 30% of current oil imports by 2050 (Zhao 2015). However, the biofuel is experiencing a setback from the threat of food security. For example, in Northeastern and Northern province, where the majority of bioethanol feedstock originates from, 10% of corn production is used as feedstock (Zhao 2015). Concerns have been raised over grain usage, which has been projected to increase from 0.71 % grain usage in 2006 (Zhao 2015). The government is still encouraging the development of bioethanol using non-food sources, by providing subsidies and low taxes, although the average subsidy has decreased from US$ 0.20 in 2008 to US$ 0.17 in 2010 (Zhao 2015).

On the other hand, biodiesel, which is produced in small-scaled plants, are receiving more development incentives from the government. Most of China’s biodiesel is produced in small plants that range from 200 to 20,000 tons of production, but face high feedstock prices because of competition with other manufacturing industries (Zhao 2015). In 2011, the Ministry of Finance and the State Administration of Taxation temporarily removed up to 5 % of consumption tax for biodiesel producers to encourage bioethanol production (Zhao 2015). Most local governments incorporate biodiesel into existing transportation fuel (diesel, petrol). For example, in Hainan Province, intense research and development program on biodiesel has been initiated by the state-owned China National Offshore Oil Company has resulted in experimental blend rate of 2 to 4 % biodiesel in transportation fuel (Zhao 2015). However, the end product is not entirely sustainable and does not cut down reliance on diesel and petrol.

In the past decades, the garbage incineration electricity generation capacity has increased in China to produce 4.7 GW at the end of 2015 (Yang 2017). Municipal soldi waste (MSW) that collected annually is projected reach 200 million tonnes in 2018, most is generated in urban areas (Yeung, Dai and Wu 2016). Most of the waste produced are stored in landfills (72.6%) but incineration is preferred (Yeung, Dai and Wu 2016). With 12th FYP targets set to increase incineration facilities to 48% by 2015, new plants were constructed (95 plants over 2009 – 2014) and plants’ processing capacity increased (Yeung, Dai and Wu 2016). The central government has created new emission standards in 2016 that are tighter than before, however they are much lower than that administered in the EU (Yeung, Dai and Wu 2016).

Conclusions

Since the 1970s, China has been prioritizing economic development, establishing a regime whereby strong industrial policies shape how local markets and governments respond, and how consumers and producers behave (Zhang 2011). In the same way, China has utilized policy mechanisms to build the renewable energy industry in China (Zhang 2011). However, local deployment and demand for renewable energy relies on the cooperation of local government and private actors. As we have seen in sections above, the central government has allowed for local autonomy to set energy and industry standards, in order to gain local support (Sternfeld 2017). Additionally, China has been decentralizing its power, redistributing it to more agencies on a regional and ministerial basis. This is important to renewable energy because it decreases the renewable energy industry’s reliance on central funding and planning, allowing market forces to dominate and regulate the industry instead (Kahn and Zheng 2016).

The main challenge with China’s objective of developing large scale renewable energy generation is the integration of renewable energy into the grid. In many regions, China has a combined heat and power (CHP) systems, which makes switching between renewable and coal-power energy inflexible because coal has to be kept running as back-up energy sources (Lewis 2013). This is particular for less stable renewable energy sources like wind, solar, and bioenergy (Lewis 2013). However, China is already constructing grid infrastructure technology that will improve grid connectivity for solar and wind energy deployment, to overcome inflexible systems and geographical separation (Koch-Weser and Meick 2015). The ultra high-voltage (UHV) transmission technology minimizes transmission losses over long distances, and the seven existing UHV are operating at 800 kV, which is more than double the operation of any country (Koch-Weser and Meick 2015). As part of NDRC plans, under the China’s West-East Electricity Transfer project, 12 new inter-regional UHV transmission lines are planned (Koch-Weser and Meick 2015).

China also continues to face structural challenges in renewable energy deployment, mainly because the five state-owned energy companies (Datang Corporation, Guodian Corporation, Huadian Group, Power Investment Corporation) do not fully rely on market forces but on policies, regulations and dominant market power to control the distribution of renewable energy (Koch-Weser and Meick 2015, Sternfeld 2017). In addition, China’s rapid rise in renewable energy manufacturing and deployment has resulted in excess supply in less-populated regions of China and industrial overcapacity (Koch-Weser and Meick 2015). This means that the capital that China and private sector has funded are underused and not used efficiently in renewable energy generation (Koch-Weser and Meick 2015). Acknowledging these big problems, China has plans to issue policies to redistribute renewable energy sector, particularly achieving efficiency in renewable energy generation and grid integration, and to decrease financial incentives in renewable energy industry (Koch-Weser and Meick 2015).

This paper has discussed how China has moved away from reliance on foreign technology and aid in technological capacity development, and transitioned into central government push for development through favorable policies. Now, China’s renewable energy industry is establishing itself, away from central government forces. The story of China’s renewable energy has shown not only the growth of the renewable energy industry, but the development of China’s society as a whole. As the country moves forward, it will be interesting to see how the development of renewable energy changes according to China’s political dynamics and maturing civil society. Even though China’s renewable energy plans do not extend past thirty years down the road, we do know its impact on the global outlook on renewable energy – it can be a success story.

References

Ahlers, Anna L., and Mette Halskov Hansen. 2017. “Air Pollution: How will China Win its Self-declared War Against it?” In Sternfeld 2017, 83-96.

Albert, Eleanor, and Beina Xu. 2016. “China’s Environmental Crisis.” Council on Foreign Relations, last modified January 18, 2016. Accessed February 20, 2018. https://www.cfr.org/backgrounder/chinas-environmental-crisis.

EIA (U.S. Energy Information Administration). 2015. “U.S. Energy Information Administration - EIA - Independent Statistics and Analysis.” International Energy Statistics, last modified 2015. Accessed April 09, 2018. https://www.eia.gov/beta/.

Gowen, Annie, and Simon Denyer. 2017. “As U.S. Backs away from Climate Pledges, India And China Step Up”. The Washington Post, last modified June 1, 2017. Accessed May 1, 2018.

Harvey, Hal, and Hu Min. 2017. “The China Carbon Market Just Launched, And it’s the World’s Largest. Here’s How it Can Succeed.” Forbes, last modified December 19, 2017. Accessed February 28, 2018. https://www.forbes.com/sites/energyinnovation/2017/12/19/the-china-carb…

IEA (International Energy Agency). 2015. “China, People’s Republic of: Balances for 2015.” International Energy Agency statistics report website. 2015. Accessed February 28, 2018.

IEA (International Energy Agency). 2016a. “National Survey Report of PV Power Applications in China 2016.” International Energy Agency website, last updated 2016. Accessed February 28, 2018. http://www.iea.org.

IEA (International Energy Agency). 2016b. “Renewable Energy Renewable Policy Update.” International Energy Agency website, last updated 2016. Accessed February 28, 2018.

IEA (International Energy Agency). 2017. “IEA – Report”. International Energy Agency website, last updated 2018. Accessed April 10, 2018.

IEA (International Energy Agency). 2018. “Policies and Measures”. International Energy Agency website last updated 2018. Accessed April 1, 2018.

Jackson, R. B., C. Le Quéré, R. M. Andrew, J. G. Canadell, G. P. Peters, J. Roy, and L. Wu. “Warning Signs for Stabilizing Global CO2 Emissions.” Environmental Research Letters 12 (11): 110202.

Kahn, Matthew E., and Zheng, Siqi. 2016. Blue skies over Beijing: Economic growth and the environment in China. Princeton University Press.

Kennedy, Merrit. 2016. “China Jails 49 Over Deadly Tianjin Warehouse Explosions.” National Public Radio (NPR), last modified November 09, 2016. Accessed February 28, 2018. https://www.npr.org/sections/thetwo-way/2016/11/09/501441138/china-jail….

Koch-Weser, Iacob, and Ethan Meick. 2018. “China’s Wind and Solar Sectors: Trends In Deployment, Manufacturing, And Energy Policy”. Staff Research Report. U.S.-China Economic and Security Review Commission. https://www.uscc.gov/sites/default/files/Research/Staff%20Report_China%….

Lampton, David M. 2014. “How China Is Ruled: Why It’s Getting Harder For Beijing To Govern”. Foreign Affairs 93 (1): 74-84.

Lema, Adrian, and Kristian Ruby. 2006. “Towards a policy model for climate change mitigation: China’s experience with wind power development and lessons for developing countries.” Energy for Sustainable Development 10 (4): 5-13.

Lewis, Joanna I. 2013. Green innovation in China: China’s wind power industry and the global transition to a low-carbon economy. Columbia University Press.

Li Hejun. 2015. China’s New Energy Revolution: How the World Super Power is Fostering Economic Development and Sustainable Growth through Thin Film Solar Technology. McGraw-Hill Education.

Li, Yu-wai, Bo Miao, and Graeme Lang. 2011. “The Local Environmental State In China: A Study Of County-Level Cities In Suzhou”. The China Quarterly 205: 115-132.

MWR (The Ministry of Water Resources of The People’s Republic of China). N.d. “Small Hydropower Development and Management in China.” The Ministry of Water Resources of The People’s Republic of China website. Accessed April 08, 2018. http://www.mwr.gov.cn/english/mainsubjects/201604/P02016040651014953644….

Rohde, Robert A., and Richard A. Muller. 2015. “Air pollution in China: Mapping of Concentrations and Sources.” PloS one 10 (8).

Shapiro, Judith. 2016. China’s environmental challenges. John Wiley & Sons.

Sternfeld, Eva, ed. 2017. Routledge Handbook of Environmental Policy in China. Taylor & Francis.

FS-UNEP and BNEF (Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance and Bloomberg New Energy Finance). 2017. “Global Trends in Renewable Energy Investment 2017.” FS-UNEP Centre Website, last updated 2017. Accessed April 01, 2018. http://fs-unep-centre.org.

World Bank Data. 2018. “China | Data”. The World Bank website, last updated 2018. Accessed March 20, 2018. https://data.worldbank.org/country/china.

UNFCCC (United Nations Framework Convention on Climate Change). 2016. “Status of Ratification of the Kyoto Protocol.” Status of Ratification, last modified April 27, 2016. Accessed February 28, 2018. http://unfccc.int/kyoto_protocol/status_of_ratification/items/2613.php.

Yang, Chi-Jen. 2017. Energy Policy in China. New York: Routledge.

Yeung, Patricia, Addison Dai, and Tony Wu CFA. 2016. “Renewable Energy in China: Transitioning to a Low-carbon Economy”. DBS Group Research. DBS Asian Insights website, last modified 2018. Accessed February 28, 2018. https://www.dbs.com/aics

Zhang, ZhongXiang. 2011. Energy and Environmental Policy in China: Towards a Low-carbon Economy. Edward Elgar Publishing.

Zhao, Jun. 2015. “Development of China’s Biofuel Industry and Policy Making in Comparison with International Practices.” Science Bulletin 60 (11): 1049-1054.